#64: How Planned Giving for Investors Cuts Taxes and Strengthens Your Legacy

Planned giving is more than charitable donations—it’s a powerful strategy for investors to reduce taxes, align wealth with values, and build a lasting legacy. In this episode of Alt Investing Made Easy, Barry Resnick of FBFK Law breaks down how planned giving, donor-advised funds, and estate planning tools help investors deploy capital with purpose and control.

Planned Giving for Investors: Taxes, Legacy, and Impact

Planned giving isn’t just about generosity, it’s a way for high-net-worth investors to align capital allocation, tax strategy, wealth planning, and legacy investing. In this episode of Alt Investing Made Easy, attorney and entrepreneur Barry Resnick demystifies how charitable strategies, donor-advised funds, and estate planning tools help mid-stage investors deploy wealth with intention. Through real-world stories and practical frameworks, this #InvestorEducation conversation empowers listeners to make confident, values-driven decisions that go beyond accumulation and toward impact.

Top Takeaways

- Planned giving is a strategic capital allocation tool, not just philanthropy—helping investors reduce taxes while directing wealth with purpose.

- Donor-advised funds (DAFs) offer flexibility and simplicity, allowing deductions now and thoughtful distribution over time.

- Entrepreneurs can apply deal-making skills to charitable impact, creating outsized outcomes through smart structures and governance.

- Tax advantages can be substantial, including deductions of up to 60% of AGI, multi-year carryforwards, and estate tax relief.

- Effective legacy planning addresses family dynamics, not just balance sheets—protecting relationships, values, and long-term outcomes.

Notable Quotes

- “Planned giving is a win-win—spiritually, morally, and financially.”

- “How many pairs of pants can you wear at one time?”

- “You can either pay the IRS—or give the money away intentionally.”

- “Donor-advised funds let you give now and decide later.”

- “Where there’s a will, there are relatives.”

Chapters

00:00 – Welcome to Alt Investing Made Easy

02:05 – What Is Planned Giving?

06:30 – Tax Benefits of Charitable Giving

09:45 – Estate Planning and Giving Through Trusts

11:00 – Donor-Advised Funds Explained

14:10 – Starting a Charity or Foundation

16:45 – Case Study: Free Wheelchair Mission

19:40 – Lori Scholars and Education as Legacy

22:30 – Wealth, Values, and “How Many Pairs of Pants?”

28:40 – Estate Planning Realities & Family Dynamics

33:20 – Final Advice for Investors

Credits

Sponsored by Real Advisers Capital, Austin, Texas

If you are interested in being a guest, please email us.

Disclaimers

“This production is for educational purposes only and is not intended as investment or legal advice.”

“The hosts of this podcast practice law with the law firm, Ferguson Braswell Fraser Kubasta PC; however, the views expressed on this podcast are solely those of the hosts and their guests, and not those of Ferguson Braswell Fraser Kubasta PC.”

© 2025 AltInvestingMadeEasy.com LLC All rights reserved

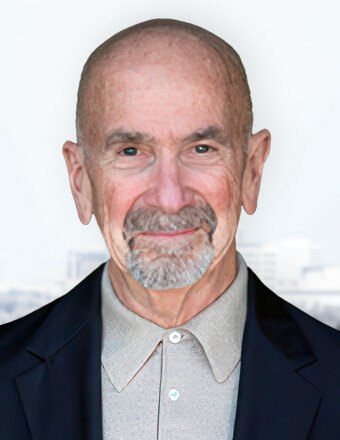

Attorney at FBFK Law

Barry Resnick has been practicing law for 50 years and has been Peer Review Rated as AV Preeminent®, the highest performance rating in Martindale-Hubbell® Peer Review Ratings™ system. He focuses primarily on business, estate, and tax planning, business transactions, and tax controversies. Barry has represented clients before judicial, administrative, and regulatory bodies at the local, state, and federal levels.

Barry is a member of Society of Trust and Estate Planning Professionals (STEP) and serves as Chairman of the Board of LEInternational, a network of worldwide law firms. He is also a former board member of the Coast Community College District, which includes Orange Coast College, Goldenwest College, Coastline Community College, and Channel 50 Public Television. Additionally, he has served as a former board member of the Lundquist Institute of Biomedical Research. Barry has shared his expertise by teaching at numerous graduate school programs at Southern California universities, as well as teaching CFP programs at the University of California, Irvine, and courses for the American Institute of Certified Public Accountants.